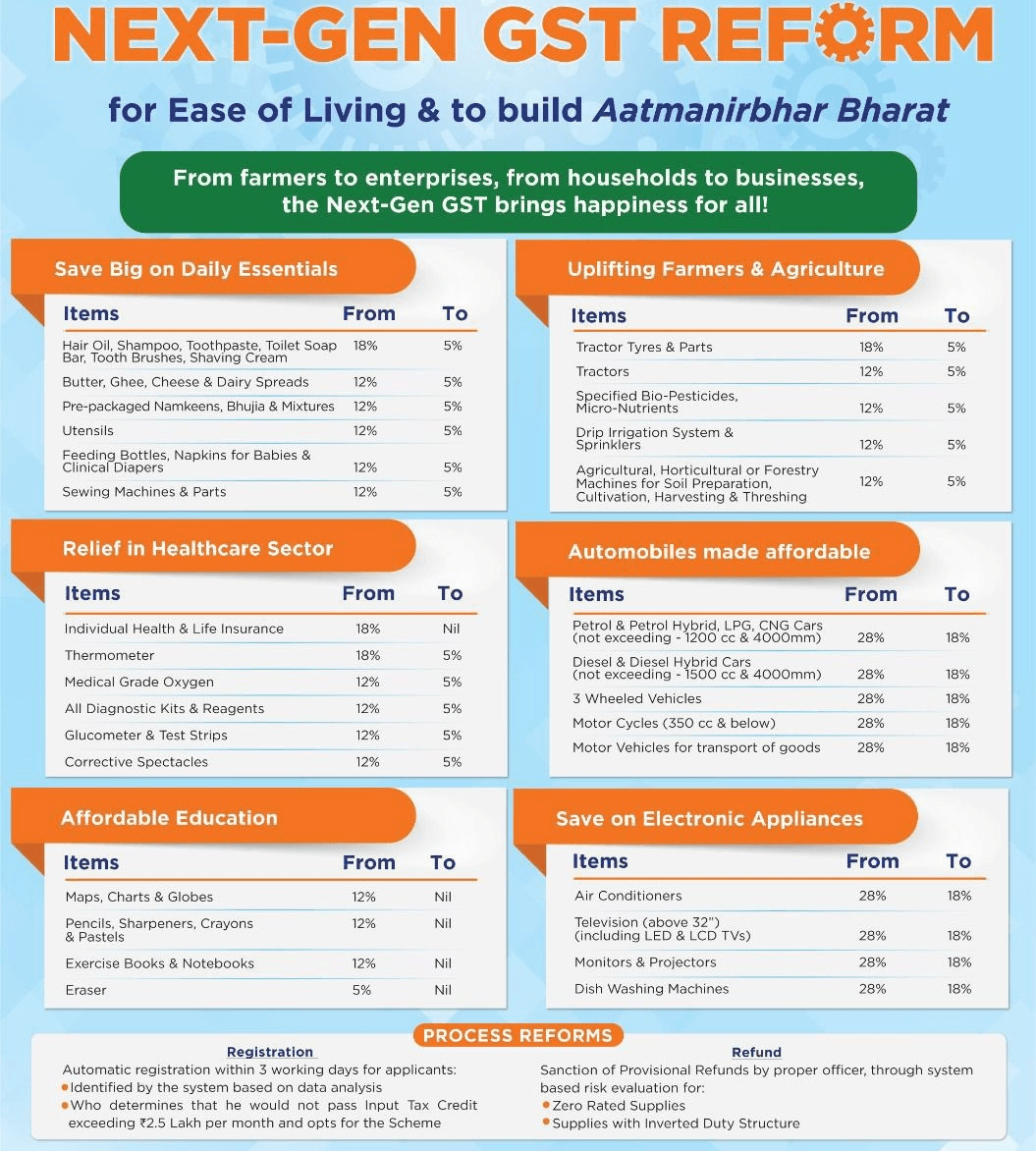

GST 2025 — Which Products Got Cheaper or Costlier

Effective from 22 September 2025: GST rates have been rationalised. Essentials, electronics, and vehicles are cheaper, while premium apparel and coal are costlier. Below is the full table.

GST Rate Changes (Table)

| Category / Product | Previous Rate | New Rate | Change | Impact |

|---|---|---|---|---|

| Milk & Dairy | 5–12% | 0–5% | ↓ Decrease | Essentials like milk, paneer exempted. |

| Packaged Food (noodles, namkeen) | 12–18% | 5% | ↓ Decrease | Cheaper FMCG items. |

| Insurance (Life & Health) | 18% | 0% | ↓ Decrease | Policies exempt, premiums drop. |

| Toothpaste, Shampoo | 18% | 5% | ↓ Decrease | Personal care now affordable. |

| Electronics (Mobiles, TVs, ACs) | 28% | 18% | ↓ Decrease | Durables cheaper ahead of festivals. |

| Small Cars, Motorcycles | 28% | 18% | ↓ Decrease | Vehicles more affordable. |

| Apparel > ₹2,500 | 12% | 18% | ↑ Increase | Premium clothing costlier. |

| Coal | 5% | 18% | ↑ Increase | Energy & industrial cost up. |

| Tobacco, Pan Masala | 28% + Cess | 40% | High | Sin goods remain costly. |

| Cement | 28% | 18% | ↓ Decrease | Lower construction cost. |

Business Checklist

- Update POS and billing software tax tables.

- Revise SKUs with correct HSN codes.

- Adjust contracts & pricing with suppliers.

- Communicate changes to staff and customers.

FAQ

- When do new rates apply?

- From 22 September 2025.

- Will bills show new GST automatically?

- Only if POS/ERP software is updated. Traders must check manually.

- Are all essentials tax-free?

- Most essentials like milk and medicines are 0%, others are 5%.